ooomarketplace.ru

Learn

Home Insurance Companies In Ohio

Progressive is equally proud to help Ohio homeowners protect their property and belongings with customized and affordable home insurance. Had not been my experience, paid a little more for better care. Currently with Ohio Mutual for home and auto and pretty happy with their rates. We found that the best home insurance companies in Ohio are Allstate, State Farm, Auto-Owners, American Family and Buckeye State Insurance. Although Ohio has insurance requirements for car owners, there is no legislation mandating residents to purchase homeowners insurance. However, those with a. Largest Manufactured Home Insurance Providers In Ohio ; American Family, 4% ; Allstate, 9% ; Progressive, 2% ; State Farm, 8%. home, rental and umbrella polices for Ohio policyholders As mutual insurance companies, we exist to serve the insurance needs of our policyholders. Getting home insurance in Ohio has never been easier with American Family. Learn about our flexible home insurance policies and start a quote today. No, homeowners insurance is not required by law in Ohio. However, in order to get a home loan, your mortgage lender will likely require you to obtain a certain. Home insurance requirements, coverage, and discounts vary by state. Discover what a Farmers Ohio home insurance policy covers and get a free quote today. Progressive is equally proud to help Ohio homeowners protect their property and belongings with customized and affordable home insurance. Had not been my experience, paid a little more for better care. Currently with Ohio Mutual for home and auto and pretty happy with their rates. We found that the best home insurance companies in Ohio are Allstate, State Farm, Auto-Owners, American Family and Buckeye State Insurance. Although Ohio has insurance requirements for car owners, there is no legislation mandating residents to purchase homeowners insurance. However, those with a. Largest Manufactured Home Insurance Providers In Ohio ; American Family, 4% ; Allstate, 9% ; Progressive, 2% ; State Farm, 8%. home, rental and umbrella polices for Ohio policyholders As mutual insurance companies, we exist to serve the insurance needs of our policyholders. Getting home insurance in Ohio has never been easier with American Family. Learn about our flexible home insurance policies and start a quote today. No, homeowners insurance is not required by law in Ohio. However, in order to get a home loan, your mortgage lender will likely require you to obtain a certain. Home insurance requirements, coverage, and discounts vary by state. Discover what a Farmers Ohio home insurance policy covers and get a free quote today.

insurance companies licensed to transact fire insurance insurance products and services that are easily accessible and priced fairly for Ohio property. Cheapest Home Insurance in Ohio for New Homes · Cheapest for $, Nationwide at $ per year · Cheapest for $, Nationwide at $ per year · Cheapest. Ohio Department of Insurance Ohio Department of Insurance. Menu. Home Agencies · Services for. Companies · Help Center · Search. The cheapest company for bundling auto and home insurance in Ohio is State Farm with an average rate of $2, The biggest average discount for bundling home. Homeowners insurance provides a financial safety net if your home and personal possessions are damaged or destroyed. Based on our study, the best homeowners insurance company in Cincinnati is Amica with a score of out of 5 in our analysis. Get Allstate home insurance today. Get a sense of pricing or weigh your coverage options to easily insure your home. Your home may be your largest financial investment. Working with your local insurance agent representing The Cincinnati Insurance Company. Westfield offers the protection you need for your home, auto, business, farm — and more. Get a free Ohio homeowners insurance quote today. Nationwide offers a variety of home insurance coverage options to protect your home and property. Top 6 Homeowners Insurance Providers in Ohio · Hippo · Allstate · State Farm · Geico · Travelers. Like most states, having home insurance in Ohio is not a legal requirement. However, it's still a worthwhile investment. Buying homeowners insurance allows you. Grange partners with independent insurance agents to provide customizable insurance coverage. Experience the ease of doing business with Grange. State Farm is by far the largest insurer in Ohio in the homeowner and auto markets. State Farm collects five times more HO premiums than its next closest. Westfield offers the protection you need for your home, auto, business, farm — and more. Great American Insurance Group Ohio © Great American Insurance Company. All Rights Reserved. Great American Insurance Group's member companies. The Ohio Insurance Institute (OII) is a member-run trade organization comprised of property and casualty insurance companies and related organizations. Ohio Mutual's insurance products are designed for you and your family. When you're ready to protect your home, your car, and even your small business or farm. In , Ohio's insurance companies More than one third (35%) of the state's insurance industry employment is in the property/casualty insurance field.

Salary For Home Loan

How many times my salary can I borrow for a mortgage in Canada? You Mortgage Brokers vs Banks · Aug 16, What type of home loan are you looking for? Are you preparing to buy a house but are unsure how much income should go to your loan payment? Learn what percentage of income is needed for mortgage. The 28% mortgage rule states that you should spend 28% or less of your monthly gross income on your mortgage payment (eg, principal, interest, taxes and. For example, if you have an in-hand salary of ₹50K, you are eligible for home loans of up to ₹ lakhs. And, if you bring home a salary of ₹75K, you can. One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. Normally banks offer upto % of your monthly salary. If your salary is Rs. /- then you can get around Rs. lakhs as loan from bank. Can I get Home Loan if my salary is Rs 20,? While a monthly salary of Rs 20, may limit your eligibility, getting a Home Loan is still possible. The loan. How many times my salary can I borrow for a mortgage in Canada? You Mortgage Brokers vs Banks · Aug 16, What type of home loan are you looking for? Are you preparing to buy a house but are unsure how much income should go to your loan payment? Learn what percentage of income is needed for mortgage. The 28% mortgage rule states that you should spend 28% or less of your monthly gross income on your mortgage payment (eg, principal, interest, taxes and. For example, if you have an in-hand salary of ₹50K, you are eligible for home loans of up to ₹ lakhs. And, if you bring home a salary of ₹75K, you can. One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. Normally banks offer upto % of your monthly salary. If your salary is Rs. /- then you can get around Rs. lakhs as loan from bank. Can I get Home Loan if my salary is Rs 20,? While a monthly salary of Rs 20, may limit your eligibility, getting a Home Loan is still possible. The loan.

Your minimum take home salary should be 25, per month to be eligible for Bajaj Finserv home loan. How much home loan can I get for my salary? Most lenders base their home loan qualification on both your total monthly gross income and your monthly expenses. These monthly expenses include property. home value is the ideal amount of money for a down payment. This amount buys you equity in the home, which helps secure the loan. When you don't have a. Need some more information? Now that you have your estimated home price, check out different loan. Minimum Salary: ₹10, p.m.; Minimum business income: ₹2 lac p.a.; Maximum Loan Term: 30 years. Financial Position: The present and the future income of. Calculate loan amounts and mortgage payments for two scenarios; one using aggressive underwriting guidelines and another using conservative guidelines. Need some more information? Now that you have your estimated home price, check out different loan. To determine your front-end ratio, multiply your annual income by , then divide that total by 12 for your maximum monthly mortgage payment. Some loan. While every person's situation is different (and some loans may have different guidelines), here are the generally recommended guidelines based on your gross. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. How many times my salary can I borrow for a mortgage? Most financial institutions allow anywhere between % of your monthly salary as EMI, which helps calculate your net loan amount. What is the role of a co-. Category: Salaried. Self Employed · Gross Monthly Salary: Gross Annual Income: · Date of Birth: Date of Birth / DOI: · Tenure (months): · CIBIL Score: and above. To determine your front-end ratio, multiply your annual income by , then divide that total by 12 for your maximum monthly mortgage payment. Some loan. Your minimum take home salary should be 25, per month to be eligible for Bajaj Finserv home loan. How much home loan can I get for my salary? Most banks/ lenders decide the loan amount up to 60 times one's monthly salary. So, if you earn your monthly salary is Rs 25,, you can get a loan amount of. How much house can I afford based on my salary? · Your DTI ratio is the main factor lenders use to determine how much they'll qualify you to borrow. · Your income. Most financial institutions allow anywhere between % of your monthly salary as EMI, which helps calculate your net loan amount. What is the role of a co-. Assuming that you have minimal expenses and a good credit score, most banks will be ready to offer you a Home Loan of around Rs lakh on a salary of Rs.

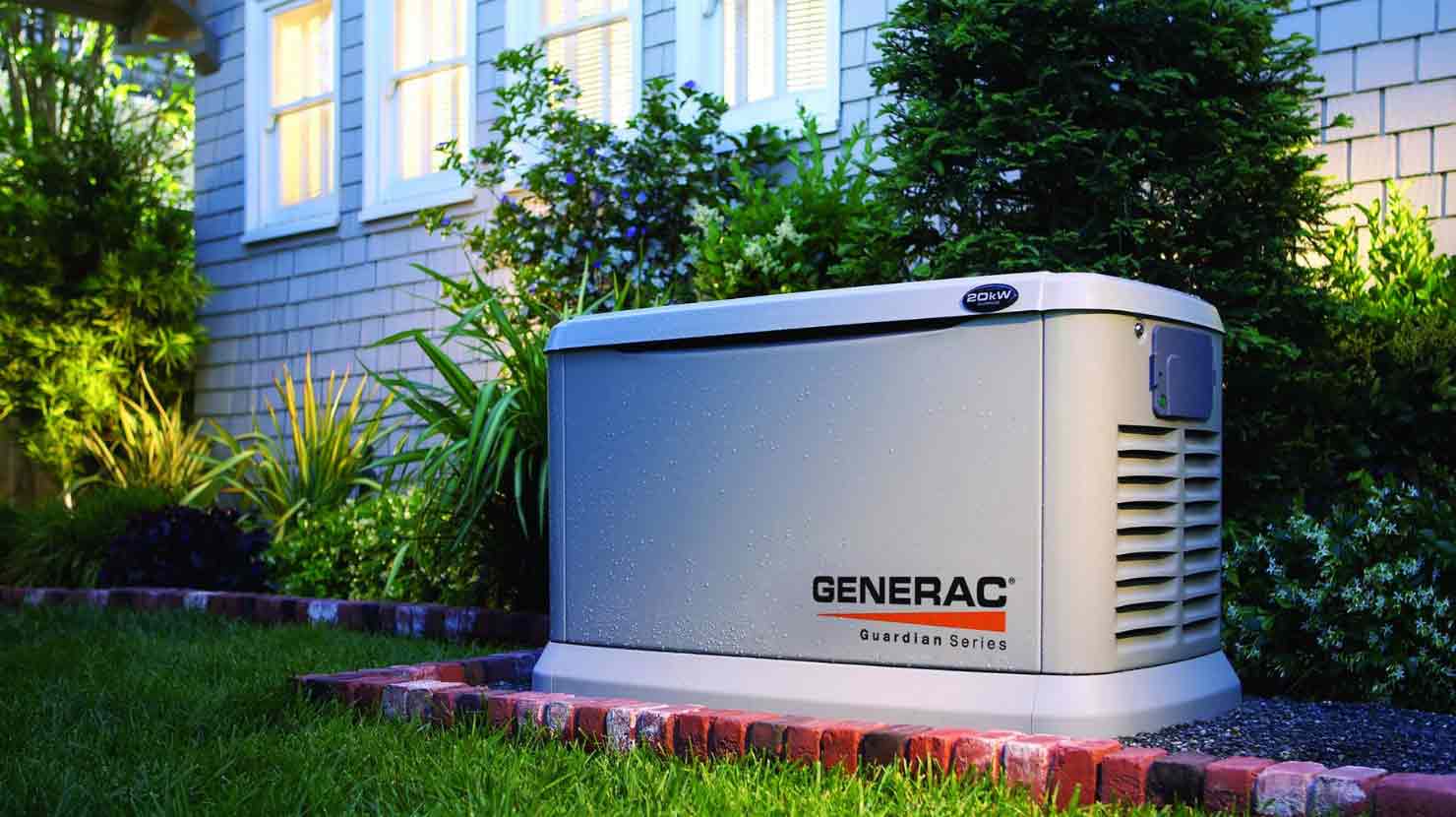

Best 22kw Whole House Generator

Built in the United States, the Generac Guardian is the gold standard for home standby generators. Boasting 22kW of power, the Guardian can be set up. The Generac Guardian Series 22kW/kW Air-Cooled Home Stand-By Generator boasts True Power™ Technology for quality power with less than 5% harmonic distortion. I purchased an 11kw Generac (natural gas) and a A transfer. The whole project with install cost me $ I have lost power here in the northeast for days. Price · Generac Wi-Fi Guardian Series 24kW Home Standby Generator 1ph w/ Amp SE · Generac Wi-Fi Guardian Series 22kW Home Standby Generator 1ph w/. The Generac 22kW Air Cooled Home Standby Generator with WiFi Amp is one of the most powerful air-cooled generators on the market today and can can provide. Generac 22kW Air Cooled Guardian Series Home Standby Generator with Amp Transfer Switch. Briggs & Stratton PowerProtect DX 22kW Home Standby Generator: A commercial-grade generator that can be used to keep your whole home powered in an outage. Ultimately, it comes down to your budget. But if you can invest in a standby generator, then the Briggs and Stratton PowerProtect 26kW Home Standby Generator is. Best-selling whole house generators from Generac include the Guardian model 22kW and the Guardian model 24kW. Standby generators to. Built in the United States, the Generac Guardian is the gold standard for home standby generators. Boasting 22kW of power, the Guardian can be set up. The Generac Guardian Series 22kW/kW Air-Cooled Home Stand-By Generator boasts True Power™ Technology for quality power with less than 5% harmonic distortion. I purchased an 11kw Generac (natural gas) and a A transfer. The whole project with install cost me $ I have lost power here in the northeast for days. Price · Generac Wi-Fi Guardian Series 24kW Home Standby Generator 1ph w/ Amp SE · Generac Wi-Fi Guardian Series 22kW Home Standby Generator 1ph w/. The Generac 22kW Air Cooled Home Standby Generator with WiFi Amp is one of the most powerful air-cooled generators on the market today and can can provide. Generac 22kW Air Cooled Guardian Series Home Standby Generator with Amp Transfer Switch. Briggs & Stratton PowerProtect DX 22kW Home Standby Generator: A commercial-grade generator that can be used to keep your whole home powered in an outage. Ultimately, it comes down to your budget. But if you can invest in a standby generator, then the Briggs and Stratton PowerProtect 26kW Home Standby Generator is. Best-selling whole house generators from Generac include the Guardian model 22kW and the Guardian model 24kW. Standby generators to.

Whole House Generators ; Honeywell 22 kW Automatic Standby Generator with Wi-Fi & A Transfer Switch · Includes A Transfer Switch ; Kohler 20kW Residential. The Generac 22KW Automatic Home Standby Generator provides reliable backup power for homes. Powered by a cc G-Force series engine running on propane. Generac is a good and reliable brand. I have a 24kw Generac standby generator at my house. Anything can break though. Even brand new equipment. Key Features ; Availability Inventory ; Year ; MakeGenerac ; Model22Kw Home Backup Generator With Free Mobile # Honeywell's reliable standby generator features a powerful, automotive-style liquid-cooled engine that automatically starts within seconds of a power outage. Guardian 22kW Home Backup Generator with Whole House Transfer Switch WiFi-Enabled - Model # · Guardian 26kW Home Backup Generator with amp transfer switch -. Performance meets value. PowerProtect™ 22kW¹ Home Standby Generators feature our NGMax™ technology, providing more power than the competition. Choosing the Right Whole House Generator · $ OFF | 8//4 · Generac 24kW Guardian Generator with Wi-Fi & A SE Transfer Switch · Generac 22kW. 5 Year Limited Warranty for automatic standby generators. True Power™ Technology: delivers best-in-class power quality with less than 5 percent total. Generac 22Kw Home Backup Generator With Free Mobile # ; Displacement, cc ; Length, 48 in. ( cm) ; Width, 25 in. ( cm) ; Height, 29 in. ( Shop the Best Standby Generator Brands: Generac–Briggs & Stratton–Cummins–Kohler–Champion. Automatic Backup Generators for Home & Business. 22 kW Whole House Home Standby Generator and A Switch with aXis Technology · W Rated · 67 dBA Noise Level · cc Engine · A Transfer Switch. Generac 22kW Air Cooled Guardian Series Home Standby Generator with Amp Transfer Switch. Generac® Guardian 22kW Air-Cooled Standby Generac Generator, NG/LP, WiFi Enabled As the #1 selling home standby generator brand, Generac's® Guardian Series®. The Generac 22Kw whole house generator cost and return is a no-brainer choice for your home, peace of mind, and security. Generac Watt Guardian Series (22 kW) home standby generator is the largest air-cooled home standby generator on the market best in the market. This Generac Guardian 22kW Air-Cooled Home Standby Generator can provide whole-house backup power with the included Amp Automatic Transfer Switch · The. The 22 kW Guardian® Series home standby generator is the largest air-cooled home standby generator on the market. Not only does it deliver all the features. One of the most powerful air-cooled generators on the market today, the Guardian® Series 22 kW automatic home standby generator can provide whole-house backup. One of the most powerful air-cooled generators on the market today, the Guardian® Series 22 kW automatic home standby generator can provide whole-house.

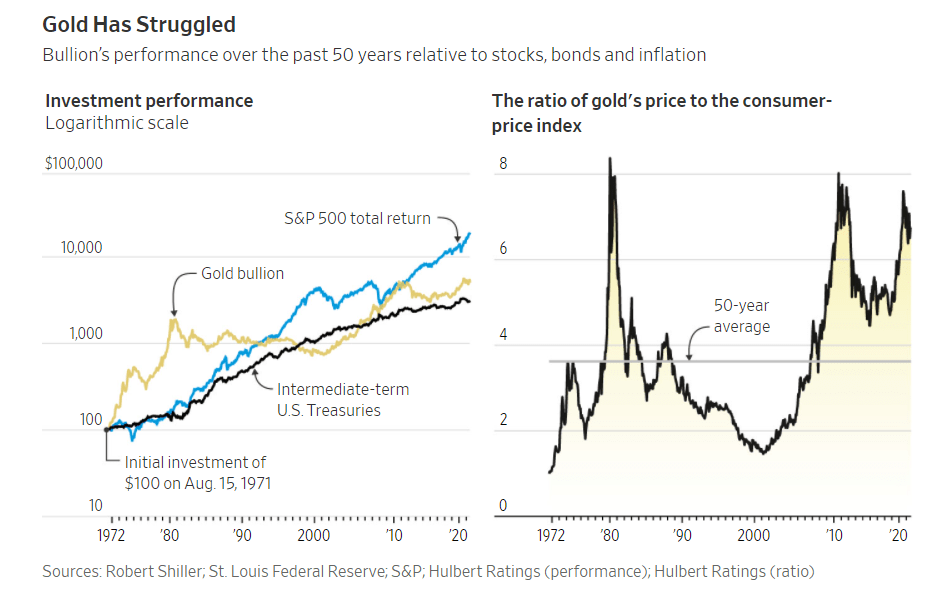

Is Gold Better Than Stocks

One factor to consider if you're buying gold miner stocks, however, is that they “do not provide the same downside capture or diversification as physical gold. The large return difference in favor of gold stocks versus gold leads the authors to conclude. (p. 76): “The investment benefits are considerably larger if the. Gold vs Silver: 4 Key Differences You Should Know · 1. Silver May Be More Tied to the Global Economy · 2. Silver Is More Volatile than Gold · 3. Gold Has Been a. That's because adding Gold in your investment portfolio helps you reduce risk through diversification. The price of Gold and equities are mostly negatively. Stocks offer growth and income potential but come with higher volatility. Gold provides stability and a hedge against both inflation and economic uncertainty. Equities are more volatile, and more susceptible to economic swings than physical commodities, such as precious metals. Unfortunately, if the company does not. Rather, they are a safer and discrete way to save value. I see precious metals as more of an emergency savings to leave my children than I do as. On an inflation-adjusted basis, gold's annualized return comes to %. The yellow metal did much better than bonds, but once again trailed stocks by a wide. So, If you're looking for a low-risk investment that can offer stability in a volatile market, gold may be your better choice. If you're willing. One factor to consider if you're buying gold miner stocks, however, is that they “do not provide the same downside capture or diversification as physical gold. The large return difference in favor of gold stocks versus gold leads the authors to conclude. (p. 76): “The investment benefits are considerably larger if the. Gold vs Silver: 4 Key Differences You Should Know · 1. Silver May Be More Tied to the Global Economy · 2. Silver Is More Volatile than Gold · 3. Gold Has Been a. That's because adding Gold in your investment portfolio helps you reduce risk through diversification. The price of Gold and equities are mostly negatively. Stocks offer growth and income potential but come with higher volatility. Gold provides stability and a hedge against both inflation and economic uncertainty. Equities are more volatile, and more susceptible to economic swings than physical commodities, such as precious metals. Unfortunately, if the company does not. Rather, they are a safer and discrete way to save value. I see precious metals as more of an emergency savings to leave my children than I do as. On an inflation-adjusted basis, gold's annualized return comes to %. The yellow metal did much better than bonds, but once again trailed stocks by a wide. So, If you're looking for a low-risk investment that can offer stability in a volatile market, gold may be your better choice. If you're willing.

Gold does not provide a regular income stream, instead it relies on an increase in value to realise a return on investment. For thousands of years gold has. The gold market has outperformed the stock market by a 4 to 1 ratio. It's true, plus gold also comes with a number of tangible benefits over investing in paper. Mining companies: Investors can get exposure through equity in companies that mine for gold, including the purchase of individual stocks or as part of a fund. Over the longer term, stocks seem to outperform gold by about 3-to-1, but over shorter time horizons, gold may win out. Investing in gold versus bitcoin comes down to your risk tolerance, goals, and preferences about asset tangibility and stability. Gold is suited for those. Rather, they are a safer and discrete way to save value. I see precious metals as more of an emergency savings to leave my children than I do as. If you are completely new to investing, this lesson will help you learn more about stocks and shares, as well as precious metals. This chart compares the performance of the S&P , the Dow Jones, Gold, and Silver. The Dow Jones is a stock index that includes 30 large publicly traded. Despite the connection, investing in mining companies is, by and large, an entirely different prospect to buying physical gold. Mining companies: Investors can get exposure through equity in companies that mine for gold, including the purchase of individual stocks or as part of a fund. You can't treat owning physical gold like stocks. Gold will not give your dividends or big returns like stocks. Holding gold is a long term. In short, stocks are the better long-term investment. In the short-term, the price spikes in gold may outperform stocks, however. I would upload. But investing in gold is better than stocks when it comes to risk factors and market volatility. If you understand inflation, market nature, liquidity, and. Of all the precious metals, gold is the most popular as an investment. Investors generally buy gold as a way of diversifying risk, especially through the. While it has proven less volatile than shares during times of economic distress, for example, it has made lower gains during stock market rallies. Gold can. This chart compares the historical percentage return for the Dow Jones Industrial Average against the return for gold prices over the last years. A diversified investment portfolio is an excellent way to protect your wealth. Among the many different options, from stocks and bonds to real estate and. As you can see, gold often performs dramatically better than other assets during the most severe economic downturns. Additionally, because gold is a global. Gold is typically seen as a 'safe-haven'- a lower risk asset that appeals to investors in times of economic or political crisis. A low but positive P/E implies a company is generating higher earnings than its valuation. Why other stocks didn't make the cut. Many top gold mining stocks are.

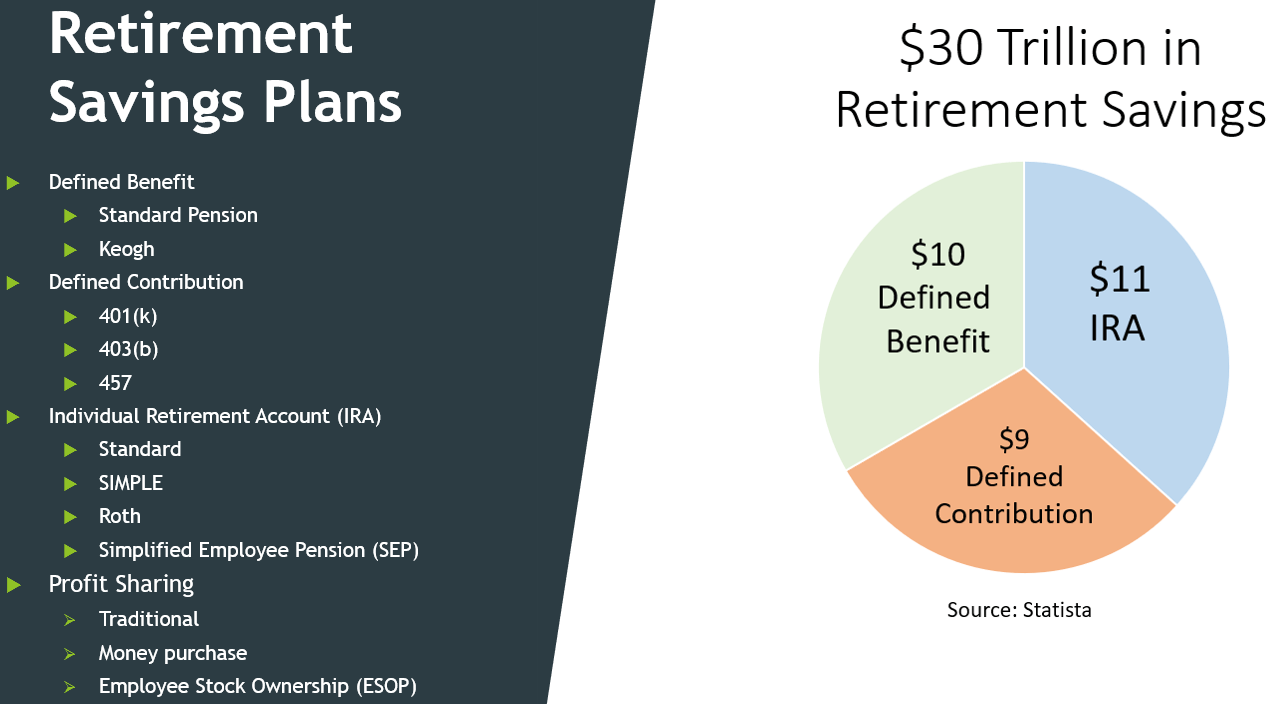

Cheapest 401k Plan

Offering (k) plans as a small business is easier than you think. Our low-cost small business retirement plans are fully integrated with Gusto payroll. Some (k) plan providers cater to smaller companies, such as a startup or those with fewer than 50 employees, while others are set up for medium-sized or. Simply Retirement by Principal® is a (k) plan solution that's designed specifically for small businesses with fewer than employees. Simple, low-cost, full-scale – our flexible Solo (k) plans allow self-employed individuals to maximize their retirement savings and still enjoy the same. Sole proprietor (k) plans, or Uni-Ks, generate substantial interest among sole proprietors and self-employed individuals such as consultants, accountants. A SIMPLE IRA (Savings Incentive Match Plan for Employees) is a great starter plan that encourages employees to contribute to their retirement. View the Ascensus. ShareBuilder k is a good choice if you want to keep costs low, given that their administrative fees are some of the most affordable in our survey. We are ERISA Plan Fiduciaries Who Serve Employers and Plan Participants Nationwide · Employers and plan participants save with our flat-fee plan pricing for Affordable (k) plans built for any size business · Low Cost Sticker. Affordable. Our Solo (k) plans start at $8/month, while our (k) plans for. Offering (k) plans as a small business is easier than you think. Our low-cost small business retirement plans are fully integrated with Gusto payroll. Some (k) plan providers cater to smaller companies, such as a startup or those with fewer than 50 employees, while others are set up for medium-sized or. Simply Retirement by Principal® is a (k) plan solution that's designed specifically for small businesses with fewer than employees. Simple, low-cost, full-scale – our flexible Solo (k) plans allow self-employed individuals to maximize their retirement savings and still enjoy the same. Sole proprietor (k) plans, or Uni-Ks, generate substantial interest among sole proprietors and self-employed individuals such as consultants, accountants. A SIMPLE IRA (Savings Incentive Match Plan for Employees) is a great starter plan that encourages employees to contribute to their retirement. View the Ascensus. ShareBuilder k is a good choice if you want to keep costs low, given that their administrative fees are some of the most affordable in our survey. We are ERISA Plan Fiduciaries Who Serve Employers and Plan Participants Nationwide · Employers and plan participants save with our flat-fee plan pricing for Affordable (k) plans built for any size business · Low Cost Sticker. Affordable. Our Solo (k) plans start at $8/month, while our (k) plans for.

Compare our small-business retirement plans · Vanguard SEP-IRA (One person) · Ascensus Individual(k) · Ascensus SIMPLE IRA · Ascensus SEP IRA (Multiple participants). Fidelity offers fixed fees for the employer with their small business k plans, $ setup and $ per quarter for administration. (k) fees can range between % and 2% or even higher, based on the size of an employer's (k) plan, how many people are participating in the plan, and. Small business (11 employees) I'm looking for a low cost k admin plan, that also offers good low cost index funds. Any recommendations? Fidelity Advantage (k). An affordable plan for small businesses looking to offer a (k) for the first time. Learn more. work place icon. Fidelity (k). We've researched setup costs, prices for employers, plan types, investment fees and more to determine the best employee retirement plan providers for small. A Simplified Employee Pension Plan (SEP) IRA is a flexible retirement plan offering the potential for tax-deferred growth to business owners and their. It's based on their account assets, and ranges between % and % depending on the plan tier and pricing selected. When an employee leaves your company. Contributions to an Individual (k) Plan can help reduce your current taxable income while saving for retirement. · Choice of either pre-tax and/or after-tax . $ Flat Annual Fee for Being the Plan Document Provider · IRS Required Plan Updates. · Education regarding investment rules (e.g., investing in real estate. Companies seeking very low-cost investing options for employees and full-service support should consider using one of Vanguard's (k) plans. Empower. Best for. Save More with Our Low Fees! ; Establishment Fee. New (Start-Up) Plans. $ ; Annual Fees. Base Fee. Base fee covers up to 30 eligible employees. Each additional. Paid by Employer: $ one-time start-up fee; $ per quarter for plan administration. Paid by Employee: $25 per quarter for record keeping; % on account. Small business owners can offer employees (and themselves) a tax-deferred retirement savings plan similar to the plans offered by larger corporations—but. A modern (k) your team will love. Get an easy, affordable retirement plan that can be customized for your business goals and your team. When you consider the fees in your (k) plan and their impact on your retirement income, remember that all services have costs. If your employer has selected. Rarely do you see low cost index funds available in most plans. The typical plan is laden with expensive actively funds where the manager is sharing their fees. While cost is an important factor to bear in mind, the cheapest (k) plan might not always be right for your business. Consider plans with features and. GO-Starter. for very small companies · 25 · $4 per participant % AUM fee. An excellent alternative to a state-sponsored program. ; GO-Plus. for most small. The Solo k provides more investment options, higher contribution limits, and the lowest fees of any fully self directed retirement plan.