ooomarketplace.ru

Learn

Stocks To Buy On The Dip Now

Thinking about buying the dip? When talking about stocks Maybe a stock that was trading for $ per share, for example, is now at $95 or even lower. The market rotation out of the technology sector (NYSEARCA:XLK) might be mostly done, and we could be close to a tactical opportunity to “buy the dip,” J.P. This is sometimes called "buying the dip." However, even though the average purchase price would've gone down, there is an equal loss on the original stock—a. This is sometimes called "buying the dip." However, even though the average purchase price would've gone down, there is an equal loss on the original stock—a. So when do you buy? If you are buying when there is a dip, you first must be able to tell in real time that itnis a dip and not the. CRWD seems like a dip play until you realize how many companies will move away from them in renewal. Revenue will crater. Nows the chance for. I try to note new stocks I run across in my reading to research further and I'd like to hear what others here have on their must buy / watch. Thinking about buying the dip? When talking about stocks or any financial asset, a dip is a drop in price. You might buy the dip if you think the price will. The buy-the-dip stock list is composed of stocks with strong earnings performance over the last five years. These are companies that are growing and are. Thinking about buying the dip? When talking about stocks Maybe a stock that was trading for $ per share, for example, is now at $95 or even lower. The market rotation out of the technology sector (NYSEARCA:XLK) might be mostly done, and we could be close to a tactical opportunity to “buy the dip,” J.P. This is sometimes called "buying the dip." However, even though the average purchase price would've gone down, there is an equal loss on the original stock—a. This is sometimes called "buying the dip." However, even though the average purchase price would've gone down, there is an equal loss on the original stock—a. So when do you buy? If you are buying when there is a dip, you first must be able to tell in real time that itnis a dip and not the. CRWD seems like a dip play until you realize how many companies will move away from them in renewal. Revenue will crater. Nows the chance for. I try to note new stocks I run across in my reading to research further and I'd like to hear what others here have on their must buy / watch. Thinking about buying the dip? When talking about stocks or any financial asset, a dip is a drop in price. You might buy the dip if you think the price will. The buy-the-dip stock list is composed of stocks with strong earnings performance over the last five years. These are companies that are growing and are.

The term, buying the dip, refers to a retracement in stock price that constitutes a short term support. It works very well in trending markets. Rejecting previous prices assumption. You're assuming that buying the dip now is better than buying into the market earlier with that same available money. This. The term, buying the dip, refers to a retracement in stock price that constitutes a short term support. It works very well in trending markets. Financhill just revealed its top stock for investors right now so there's no better time to claim your slice of the pie. See The #1 Stock Now >>. The author. "Buying the dip" is a phrase used when purchasing a stock once it has fallen in value or " at a discount". It has its benefits, and it also has its risks. buy beleaguered stocks. In theory, this is a great way to generate Today, we'll take deep dive into the risks in buying the dips, the. Buy on Dips ; Nesco Ltd. , 6 ; GHCL. , 6 ; JTEKT India. , 6 ; West Coast Paper. , 8. Stocks to BUY on the DIP ; 1. Hindustan Zinc, , , ; 2. Adani Total Gas, , , Buying the dip involves purchasing stocks during a market decline, and now, then a dip could allow you to buy them at a discount. Having a system. best companies to buy at dip ; 1. Bosch, ; 2. P & G Hygiene, ; 3. Bajaj Holdings, ; 4. Bharat Electron, best companies to buy at dip ; 2. P & G Hygiene, ; 3. Bajaj Holdings, ; 4. Bharat Electron, ; 5. Divi's Lab. It represents a % return. Now, consider an exogenous event that causes the price of the stock of ABC Company to decline to $5/share. However, the investment. The strategy is also ideal for trading certain types of markets prone to high-value dips over time. Some stocks that offer valuable dip opportunities include. Today I bought US Consumer Staples, a few shares of HVPE and some RICA – grand total of about 1% by portfolio size, just to bring the numbers up. If the. Stock Screener Stock Ideas Buy The Dip. Buy The Dip: Potential Stocks to Buy on the Dip. Companies with strong forecast and valuation scores that may offer a. 2 Growth Stocks Down 45% and 73% to Buy on the Dip, According to Wall Street · 1. Zscaler · 2. Paycom Software. Today I bought US Consumer Staples, a few shares of HVPE and some RICA – grand total of about 1% by portfolio size, just to bring the numbers up. If the. The strategy is also ideal for trading certain types of markets prone to high-value dips over time. Some stocks that offer valuable dip opportunities include. The market rotation out of the technology sector (NYSEARCA:XLK) might be mostly done, and we could be close to a tactical opportunity to “buy the dip,” J.P. Thinking about buying the dip? When talking about stocks Maybe a stock that was trading for $ per share, for example, is now at $95 or even lower.

Boost Oxygen Sales

Robert Van Malderghem. Chief Financial Officer at Boost Oxygen ; Robert Neuner ; Angela Gibson. Denver, CO ; Alberto Mascaro. Vice President of Sales at Boost. Founded in , Boost Oxygen is currently the best-selling and most trusted oxygen canister brand in the world. A few deep breaths of Boost Oxygen helps you. For more information please contact us via email at [email protected] or by phone at Boost Oxygen is 95% Pure Aviator's Breathing Oxygen compressed into aluminum canisters for any non-Medical use. Boost Oxygen LLC · Old Gate Ln. Milford, CT · () · [email protected] Boost Oxygen Balance is 95% pure supplemental oxygen, no prescription needed. Boost provides nearly 5X the pure oxygen you get from normal air. Boost Oxygen Supplemental Oxygen Natural Large 10 Liter, 1 Pack, Model Free day returns. Best seller. Popular pick. for "boost oxygen 10 liter". Boost Oxygen: Provider of portable, lightweight and completely recyclable supplemental oxygen canisters, made in the USA and available at retailers. The first portable pure oxygen canister created for athletes and fitness enthusiasts. Includes: (1) 10 Liter Large Orange Sport Canister. Robert Van Malderghem. Chief Financial Officer at Boost Oxygen ; Robert Neuner ; Angela Gibson. Denver, CO ; Alberto Mascaro. Vice President of Sales at Boost. Founded in , Boost Oxygen is currently the best-selling and most trusted oxygen canister brand in the world. A few deep breaths of Boost Oxygen helps you. For more information please contact us via email at [email protected] or by phone at Boost Oxygen is 95% Pure Aviator's Breathing Oxygen compressed into aluminum canisters for any non-Medical use. Boost Oxygen LLC · Old Gate Ln. Milford, CT · () · [email protected] Boost Oxygen Balance is 95% pure supplemental oxygen, no prescription needed. Boost provides nearly 5X the pure oxygen you get from normal air. Boost Oxygen Supplemental Oxygen Natural Large 10 Liter, 1 Pack, Model Free day returns. Best seller. Popular pick. for "boost oxygen 10 liter". Boost Oxygen: Provider of portable, lightweight and completely recyclable supplemental oxygen canisters, made in the USA and available at retailers. The first portable pure oxygen canister created for athletes and fitness enthusiasts. Includes: (1) 10 Liter Large Orange Sport Canister.

Whether you're an athlete, traveller, or just need a quick pick-me-up, Boost Oxygen is the perfect solution. Get your canister today and feel the. Multi-Pack: Medium (pack) · (12) Medium 5 Liter Canisters · Available in 95% Pure Natural Unscented Oxygen (Temporarily out of stock), Peppermint, Menthol-. This item is excluded from discounts, sales, and promotions. Credit card. Description. Oxygen to Go! Boost Oxygen provides pure, all-natural respiratory support. The Boost Oxygen Medium Natural 5 Liter is a portable lightweight, and convenient oxygen canister for consumers. It contains 5 liters of 95% Pure Aviators. Buy Boost Oxygen Canned Oxygen for Breathing for Home Use, Exercise, or Altitude Sickness, Includes Sealed Cap & Mask, Liter Canister, Natural, 2 Pack on. Patented mask design and trigger operation allows easy 1-hand use. The 3L bottle provides 60 one-second inhalations. Note: Boost Oxygen is not a prescription or. Boost Oxygen is portable, light-weight, oxygen canisters for use as a supplement to aid in sports recovery, high altitude, health and wellness. Robert Van Malderghem. Chief Financial Officer at Boost Oxygen ; Robert Neuner ; Angela Gibson. Denver, CO ; Alberto Mascaro. Vice President of Sales at Boost. Boost Oxygen: Provider of portable, lightweight and completely recyclable supplemental oxygen canisters, made in the USA and available at retailers. Natural Boost Oxygen is 95% pure supplemental oxygen, no prescription needed. Boost provides nearly 5X the pure oxygen you get from normal air. Introducing BOOST OXYGEN: SPORT – The First Portable Pure Oxygen Canister Created For Athletes and Fitness ooomarketplace.rues: Available in a 10 Liter. The Boost Oxygen Medium Natural 5 Liter is a portable lightweight, and convenient oxygen canister for consumers. It contains 5 liters of 95% Pure Aviators. Boost Oxygen 10 Liter Can - Natural · $ · List Price: $; Item #; PN: · In Stock. Boost Oxygen is all natural and safe. Unlike stimulants and energy drinks, which contain caffeine and sugars that can actually harm the body over an extended. Boost Oxygen is portable 95% pure supplemental oxygen for all-natural respiratory support. No prescription is needed. Boost Oxygen Natural Canned Oxygen Canister - 10L, Pack of 3. Brand New. $ Free shipping. Only 1 left! Explore a wide selection of quality outdoor gear at Bass Pro Shops, the trusted source for Boost Oxygen Pocket Size 3L Canister. Boat Sales · Off Road Sales. Boost Oxygen is all natural and safe. Unlike stimulants and energy drinks, which contain caffeine and sugars that can actually harm the body over an extended. Boost Oxygen is portable 95% pure supplemental oxygen for all-natural respiratory support. No prescription is needed.

Lendgo Mortgage Reviews

I used to send direct mail but had to stop because my response went to shit because mortgage companies would straight up lie about rates and I. Lendgo provides home loan, refinance mortgage, home equity and credit card services. Be the first to submit Lendgo reviews. Submit your review. © ooomarketplace.ru has a - star rating from 15 reviews, indicating a low level of customer satisfaction! 5 stars. 7 Reviews. Shop Lendgo Products from around the world. Exclusive products & global brands with the lowest shipping rates to Paraguay. Lendgo's Mortgage Mastery Podcast. Fetcharate is a rates comparison website that offers customers third party quotes for refinancing, mortgage, and VA loans. We offer competitive rates compared to those from larger financial institutions, and our convenient online banking options are first-rate. We are building our. ooomarketplace.ru is very likely not a scam but legit and reliable. Our algorithm gave the review of ooomarketplace.ru a relatively high score. Compare mortgage interest rates to find the best mortgage rates for your home loan. See daily average mortgage rate trends and the rates forecast for Before Lendgo, comparing home loans meant you had to go door-to-door to local lenders, answering the same questions everywhere, filling out the same tiresome. I used to send direct mail but had to stop because my response went to shit because mortgage companies would straight up lie about rates and I. Lendgo provides home loan, refinance mortgage, home equity and credit card services. Be the first to submit Lendgo reviews. Submit your review. © ooomarketplace.ru has a - star rating from 15 reviews, indicating a low level of customer satisfaction! 5 stars. 7 Reviews. Shop Lendgo Products from around the world. Exclusive products & global brands with the lowest shipping rates to Paraguay. Lendgo's Mortgage Mastery Podcast. Fetcharate is a rates comparison website that offers customers third party quotes for refinancing, mortgage, and VA loans. We offer competitive rates compared to those from larger financial institutions, and our convenient online banking options are first-rate. We are building our. ooomarketplace.ru is very likely not a scam but legit and reliable. Our algorithm gave the review of ooomarketplace.ru a relatively high score. Compare mortgage interest rates to find the best mortgage rates for your home loan. See daily average mortgage rate trends and the rates forecast for Before Lendgo, comparing home loans meant you had to go door-to-door to local lenders, answering the same questions everywhere, filling out the same tiresome.

compare current mortgage rates and home loans. use our rate tool to get personalized, free refinance rate quotes from the country's top lenders. Company: -. Since mortgage rates change daily, you won't be able to tell which lender offers the best rate for your circumstances unless you submit all your applications to. Go Edge offers you a fair go with a range of straightforward products featuring fixed and variable loans with competitive rates Mortgage only. Clients don't. Companies like Quicken Loans, AmeriSave Mortgage, Omaha Reverse Mortgage, Lendgo Mortgage rates for a home loan. Mortgage Loan. Provide consumers with a quick and efficient way to find the best deal on their mortgage or refinance. ooomarketplace.ru NMLS# Lendgo has 22 reviews on ooomarketplace.ru, with an average rating of out of 5. This indicates that most consumers are dissatisfied with their business. Virtual Lending jobs available on ooomarketplace.ru Apply to Loan Officer, Customer Service Representative, Mortgage Processor and more! A home equity line of credit, or HELOC, is a second mortgage that uses your home as collateral to let you borrow up to a certain amount over time. Lendgo provides home loan, refinance mortgage, home equity and credit card services. Be the first to submit Lendgo reviews. Submit your review. © Yes, it is absolutely safe to buy Lendgo's Mortgage Mastery Podcast from desertcart, which is a % legitimate site operating in countries. Since You can also email them directly contact[at]ooomarketplace.ru or via phone number at () The company's location is in Huntington Beach, CA. How To. Lendgo is a free platform that connects borrowers looking for a first-time mortgage, refinance, VA loan, or personal loan to reputable lenders who are eager. LendGo maintains a perfect A+ rating with the BBB, which, considering the extremely large number of mortgage requests they receive, is incredibly impressive. By. Gyms · Massage · Shopping. More. Providence, RI · Financial Services · Mortgage Lenders. Beeline. Beeline. (14 reviews). Mortgage Lenders. Open • Open Browse the most recent videos from channel "Lendgo's Mortgage Mastery Channel" uploaded to Rumble mortgage rates and terms. Simplify your home financing. The estimate average salary for Lendgo employees is around $46 per hour. The highest earners in the top 75th percentile are paid over $ Individual salaries. LendGo is an online lead aggregator for mortgage lenders that allows Newzip aims to improve conversion rates for mortgage leads by seamlessly connecting. Why are some mortgage rate search sites like LendingTree and Lendgo Mortgage Brokers don't get paid based on rates they provide - it's. Lendgo · See All Reviews. , reviews. ooomarketplace.ru I need to know what the Recently Updated. Sitejabber Website Reviews and Complaints; Privacy · Terms. With current mortgage rates being so low, homeowners can often times lower Step 2: Go onto Lendgo and find out how much your home is actually worth.

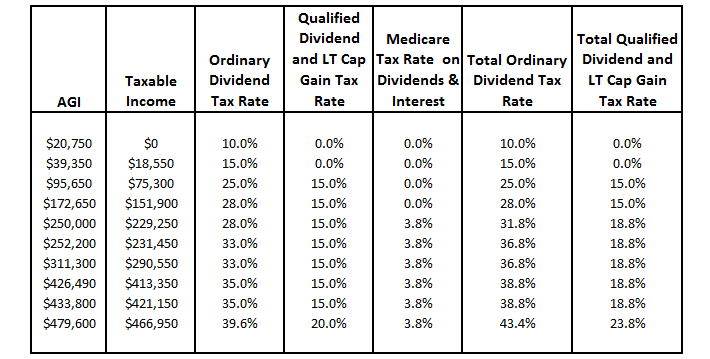

Federal Tax Rate On Qualified Dividends

Under § 1(h)(11), qualified dividend income received by an individual, estate, or trust is subject to a maximum tax rate of 15 percent. Section (b)(1)(C). Now, qualified dividends for investors with incomes over those figures will be taxed at a 20% rate (same goes for capital gains tax rates). Unqualified. The tax rate on qualified dividends is 15% for most taxpayers. (It's zero for single taxpayers with incomes under $47, as of and 20% for single. An individual's net capital gains are taxed at the rate of 7%. Dividends and interest income are taxed at a rate based on Connecticut Adjusted Gross Income. The. If you compare that to the maximum % tax on qualified dividends, the "after-tax" returns are significantly better with dividends. Say you put $, into. Qualified dividends are dividends that are eligible to be taxed at a lower tax rate. Enter the full amount of your dividends in Box 1a as Ordinary Dividends. Understanding how federal income tax brackets work · 10% on the first $11, of taxable income · 12% on the next $33, ($44,$11,) · 22% on the remaining. Capital Gains Distributions Capital gain distributions received from mutual funds or other regulated investment companies are taxable as dividend income. Whereas, non-qualified or 'ordinary' dividends are taxed at the less favorable ordinary income tax rates, which can reach a staggering 37%. Obviously. Under § 1(h)(11), qualified dividend income received by an individual, estate, or trust is subject to a maximum tax rate of 15 percent. Section (b)(1)(C). Now, qualified dividends for investors with incomes over those figures will be taxed at a 20% rate (same goes for capital gains tax rates). Unqualified. The tax rate on qualified dividends is 15% for most taxpayers. (It's zero for single taxpayers with incomes under $47, as of and 20% for single. An individual's net capital gains are taxed at the rate of 7%. Dividends and interest income are taxed at a rate based on Connecticut Adjusted Gross Income. The. If you compare that to the maximum % tax on qualified dividends, the "after-tax" returns are significantly better with dividends. Say you put $, into. Qualified dividends are dividends that are eligible to be taxed at a lower tax rate. Enter the full amount of your dividends in Box 1a as Ordinary Dividends. Understanding how federal income tax brackets work · 10% on the first $11, of taxable income · 12% on the next $33, ($44,$11,) · 22% on the remaining. Capital Gains Distributions Capital gain distributions received from mutual funds or other regulated investment companies are taxable as dividend income. Whereas, non-qualified or 'ordinary' dividends are taxed at the less favorable ordinary income tax rates, which can reach a staggering 37%. Obviously.

Corporations – 7 percent of net income; Trusts and estates – percent of net income. BIT prior year rates. Individual Income Tax, Effective July 1, The table above shows the percentage of Vanguard funds' net income eligible for reduced tax rates as qualified dividend income (QDI). Qualified dividends are eligible for a lower tax rate than other ordinary income. Generally, these dividends are reported to the estate or trust in box 1b of. No, the 0% rate applies only to the amount of long-term capital gain and qualified dividend income needed to bring your taxable income (including these items). Those non-qualified dividends, as well as other ordinary dividends, may be taxed at your ordinary income tax rate, which can be as high as 37%. If you neither. The tax rate on qualified dividends is 15% for most taxpayers. (It's zero for single taxpayers with incomes under $47, as of and 20% for single. federal deductibility limits for premiums paid on qualified Qualified Dividends are not eligible for capital gains treatment for Vermont tax purposes. Ordinary dividends are taxed as ordinary income so you can expect to pay taxes at your regular income tax rate. Depending on your income level, you can pay. The federal income tax rates on "qualified dividends" are the same as the In and going forward, qualified dividends are also subject to the net. qualified dividend income (as defined in paragraph (11)). (4) percent rate gainFor purposes of this subsection, the term “percent rate. The rates on qualified dividends range from 0 to %. The category of qualified dividend (as opposed to an ordinary dividend) was created in the Jobs and. The tax rates for qualified dividends range from 0% to 20% based on your income level. • Holding period requirements must be met for dividends to be considered. Ordinary dividends are the most common type of dividends. They're taxable as ordinary income unless they're qualified dividends. Qualified dividends are taxed at lower capital gains tax rates. If you receive them, they should appear in box 1b of your DIV. Interest income. However, the law currently permits the taxation of "qualified dividend income" at the same rate as capital gain income (section 1(h)(11) of the Code). For Instead of being taxed at ordinary income tax rates, qualified dividends are taxed at the lower long-term capital gains tax rates. "When you receive qualified. It is a tax on interest and dividends income. Please note that the I&D Tax The tax rate is 5% for taxable periods ending before December 31, Qualified dividend income is taxed at rates of 0%, 15%, or 20% depending on your taxable income, as shown in the table below. See the IRS Form instructions. Although qualified dividends are taxed at long-term capital gains rates under current tax law, you cannot use capital losses to directly offset qualified. tax deductions and exemptions for which a taxpayer might qualify. Federal taxable income is multiplied by marginal income tax rates and tax credits are.

Credit Card For Shopping

Choose which category you want to earn 3% cash back in: gas and EV charging stations; online shopping, including cable, internet, phone plans and streaming;. Elevate your shopping indulgences with the best shopping credit cards available in Singapore for , offering exclusive retail perks. Looking for the Best Credit Card Offers with the Best Available Rates? ooomarketplace.ru makes it easy to compare and apply online for all types of credit cards. Visa Secure is our EMV 3-D Secure program that makes secure authentication simple, reduces customer friction and helps prevent card-not-present fraud. What are the easiest credit cards to get approved for? · OpenSky® Plus Secured Visa® Credit Card: Best Overall · Petal® 2 Visa® Credit Card: Best for No Annual. At the end of this lesson, the student will be able to: • Describe differences among credit cards, in- cluding fees, annual percentage rates, grace periods, and. Discover the benefits of various credit cards offered by Amazon, including the Amazon Rewards Visa Card, the ooomarketplace.ru Store Card. ooomarketplace.ru Credit. Select analyzed the best store credit cards that provide rewards, special financing offers and free shipping perks that make opening a store-specific card. The Ross Credit Card is a credit card that can only be used at Ross Dress for Less stores. Once approved, you will receive a 10% discount. Choose which category you want to earn 3% cash back in: gas and EV charging stations; online shopping, including cable, internet, phone plans and streaming;. Elevate your shopping indulgences with the best shopping credit cards available in Singapore for , offering exclusive retail perks. Looking for the Best Credit Card Offers with the Best Available Rates? ooomarketplace.ru makes it easy to compare and apply online for all types of credit cards. Visa Secure is our EMV 3-D Secure program that makes secure authentication simple, reduces customer friction and helps prevent card-not-present fraud. What are the easiest credit cards to get approved for? · OpenSky® Plus Secured Visa® Credit Card: Best Overall · Petal® 2 Visa® Credit Card: Best for No Annual. At the end of this lesson, the student will be able to: • Describe differences among credit cards, in- cluding fees, annual percentage rates, grace periods, and. Discover the benefits of various credit cards offered by Amazon, including the Amazon Rewards Visa Card, the ooomarketplace.ru Store Card. ooomarketplace.ru Credit. Select analyzed the best store credit cards that provide rewards, special financing offers and free shipping perks that make opening a store-specific card. The Ross Credit Card is a credit card that can only be used at Ross Dress for Less stores. Once approved, you will receive a 10% discount.

Some of the best credit cards for shopping earn up to 6% cash back on purchases at major retailers, putting more of your money back in your pocket. Get the credit you need with no annual fee. Annual Fee. $0. Purchase Rate. % variable APR. Transfer Info. Explore valuable advice and tips for managing retail store credit cards wisely, helping you make informed decisions and maximize benefits. Maximize Your Rewards & earn more than ever before! · The GameStop Pro Credit Card is designed to optimize shopping for loyal GameStop Pros. · Get A Free Year Of. Find the best credit card for your lifestyle and choose from categories like rewards, cash back and no annual fee. Get the most value from your credit card. A flat 2% cash back card is usually the best catch-all option. Some get 3% on online shopping. Try r/creditcards, they have a very helpful list. Apple Card gives you unlimited 3% Daily Cash back on everything you buy at Apple — whether it's a new Mac, an iPhone case, games from the App Store, or even a. The Amazon Prime Secured Card, an upgrade from the Amazon Secured Card, is available to customers with an Eligible Prime Membership only, subject to credit. Our No. 1 pick is the Prime Visa. Although this card requires users to have an eligible Amazon Prime membership ($ annually, or $ a month), the. Shop with the power of choice · Featured Card · Ashley Advantage Credit Card · CareCredit Credit Card · PayPal Cashback World Mastercard® · Synchrony Car Care Credit. Grocery rewards cards earn cash back or points on your essential everyday purchases at the supermarket. We'll help you sort through all the options. Earn up to 6% cash back on the first $, plus % cash back on other everyday purchases with the U.S. Bank Shopper Cash Rewards credit card. interest charge up to $1; Annual Fee: $0–$59, based on creditworthiness. On approved purchases on the My Best Buy Credit Cards issued by Citibank, N.A. Min. If you're going to open a new business credit card to help fund your business or make daily purchases, you might as well choose one that can help you build. Use the Shop Your Way Mastercard® for eligible purchases wherever Mastercard® credit cards are accepted. Earn 5% back in points on eligible purchases at gas. Earn 3% and 2% cash back on up to $2, in combined purchases each quarter in the choice category, and at grocery stores and wholesale clubs, then earn. Small business credit cards. Power your business purchases. From points to cash back, there's a credit card with benefits made for your business. Enjoy exclusive discounts and rewards as you shop with the best shopping credit cards. Compare and apply today for a more rewarding shopping spree. Annual fee · Earn unlimited % cash back on every purchase, every day · No rotating categories or limits to how much you can earn, and cash back doesn't expire. Details. Earn $ bonus cash back after you spend $6, on purchases in the first 3 months from account opening; Earn unlimited % cash.

House Insurance Roof Leak

Does homeowners insurance cover leaks from rain? If your roof is leaking due to damage from a covered peril, your insurer may pay to repair or replace it, up to. Whether or not you know where the leak is entering your home, contact a roofing specialist to help you find the specific source of the leak and make temporary. Yes, a roof leak can significantly affect a home's insurance policy in several ways. Here's how it can impact your policy and the steps you. Home insurance covers roof leaks when the damage was caused by a covered peril. Insurance will not cover a leaking roof due to negligence. Learn the 6 key questions to ask before filing an insurance claim for your leaky roof. Ensure you're covered and avoid common pitfalls with our guide. If your roof leak is caused by a covered peril, such as sudden weather or fire incidents, damage caused by a roof leak is generally covered. However, if your. Will my homeowners insurance cover roof leaks? Homeowners insurance may cover a roof leak if it is caused by a covered peril. Suppose your roof is damaged. Most standard homeowners insurance policies will cover a leaking roof due to a covered event such as damage caused by wind and hail. Unless your policy. Typically, your homeowner's policy will also cover the cost of water damage from a roof leak if it falls under the stipulation of the perils listed in your. Does homeowners insurance cover leaks from rain? If your roof is leaking due to damage from a covered peril, your insurer may pay to repair or replace it, up to. Whether or not you know where the leak is entering your home, contact a roofing specialist to help you find the specific source of the leak and make temporary. Yes, a roof leak can significantly affect a home's insurance policy in several ways. Here's how it can impact your policy and the steps you. Home insurance covers roof leaks when the damage was caused by a covered peril. Insurance will not cover a leaking roof due to negligence. Learn the 6 key questions to ask before filing an insurance claim for your leaky roof. Ensure you're covered and avoid common pitfalls with our guide. If your roof leak is caused by a covered peril, such as sudden weather or fire incidents, damage caused by a roof leak is generally covered. However, if your. Will my homeowners insurance cover roof leaks? Homeowners insurance may cover a roof leak if it is caused by a covered peril. Suppose your roof is damaged. Most standard homeowners insurance policies will cover a leaking roof due to a covered event such as damage caused by wind and hail. Unless your policy. Typically, your homeowner's policy will also cover the cost of water damage from a roof leak if it falls under the stipulation of the perils listed in your.

Your roof leak might be covered by your home insurance, especially if it's explicitly stated in your terms and conditions. However, even if your home insurance. It is the homeowner's responsibility to maintain and take care of their roof and home, so most insurance companies do not cover roof leaks caused by improper. Homeowners insurance typically won't cover roof leaks due to general wear and tear, rot, or animal damage. Insurance will not pay for random leaks, they will only pay or consider paying for damage tied to a very specific verified event, like heavy. Homeowners insurance may cover a roof leak if it is caused by a covered peril. Suppose your roof is damaged by fire, hail or wind. which results in a leak. In. Homeowners insurance may cover a roof leak if it is caused by a covered peril. Suppose your roof is damaged by fire, hail or wind. which results in a leak. In. If the cause of the leaking roof is down to general wear and tear or poor maintenance it will not be covered by your insurance policy. In general insurance. Here's the general rule: Roof leaks are covered when they're caused by sudden, accidental events. You're generally covered if your roof leaks after a named. A homeowners insurance policy may cover roof damage if the problem resulted from an unavoidable event. For example, if someone vandalized your roof, your. Home insurance covers roof leaks when the damage was caused by a covered peril. Insurance will not cover a leaking roof due to negligence. Most standard homeowners insurance policies will cover a leaking roof due to a covered event such as damage caused by wind and hail. Unless your policy. My roof is leaking - am I covered under home insurance? Your home insurance might cover you - if the leak was caused by storm damage to your roof. In general. Typically, home insurance policies do cover roof leaks caused by sudden and accidental events, such as severe storms. These incidents are in fact often included. Some people choose not to buy a homeowners policy. They opt for water damage insurance instead, believing it includes roof leaks. However, your insurance. Most roof leaks are fully covered by insurance, meaning that you will be reimbursed for any roof repairs made. However, this is not always the case. It is. Will my homeowners insurance cover roof leaks? Homeowners insurance may cover a roof leak if it is caused by a covered peril. Suppose your roof is damaged. Most homeowners insurance won't cover leaks caused by normal wear and tear. Maintaining your roof regularly may improve your chances of an approved claim in the. In general, homeowner's insurance covers roof repairs for damages caused by an event (storm, hail, tree limbs falling, wind damage). If your. Typically, your homeowner's policy will also cover the cost of water damage from a roof leak if it falls under the stipulation of the perils listed in your. But, if a roof leak is caused by a sudden and accidental peril, it's probably covered. Many reputable roofing companies offer free, no obligation roof.

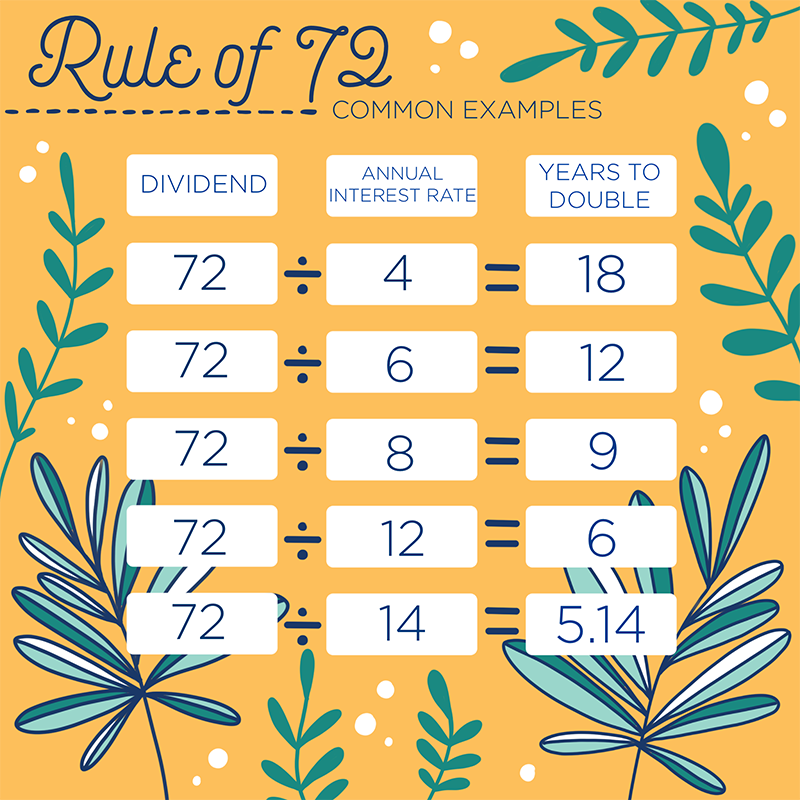

Rule Of 72

The rule says that to find the number of years required to double your money at a given interest rate, you just divide the interest rate into For example. For example, if your investment earns 6% per year on average, you would take 72 divided by 6 to determine that it will take 12 years for your money to double. The rule number (e.g., 72) is divided by the interest percentage per period (usually years) to obtain the approximate number of periods required for doubling. To use the Rule of 72 in order to determine the approximate length of time it will take for your money to double, simply divide 72 by the annual interest rate. Do you know the Rule of 72? It's an easy way to calculate just how long it's going to take for your money to double. Just take the number 72 and divide it by. You simply divide 72 by the rate of annual return (that's your interest rate). What results is an approximation of how many years it will take for you to double. The Rule of 72 determines how long an investment will take to double given a fixed annual rate of interest. Using the Rule of 72, you can easily determine how long it will take to double your money. To figure out what interest rate to look for, use the same basic. The Rule of 72 is a method to estimate how long it will take for an investment to double in value using an expected rate of return, or interest rate. Why is it. The rule says that to find the number of years required to double your money at a given interest rate, you just divide the interest rate into For example. For example, if your investment earns 6% per year on average, you would take 72 divided by 6 to determine that it will take 12 years for your money to double. The rule number (e.g., 72) is divided by the interest percentage per period (usually years) to obtain the approximate number of periods required for doubling. To use the Rule of 72 in order to determine the approximate length of time it will take for your money to double, simply divide 72 by the annual interest rate. Do you know the Rule of 72? It's an easy way to calculate just how long it's going to take for your money to double. Just take the number 72 and divide it by. You simply divide 72 by the rate of annual return (that's your interest rate). What results is an approximation of how many years it will take for you to double. The Rule of 72 determines how long an investment will take to double given a fixed annual rate of interest. Using the Rule of 72, you can easily determine how long it will take to double your money. To figure out what interest rate to look for, use the same basic. The Rule of 72 is a method to estimate how long it will take for an investment to double in value using an expected rate of return, or interest rate. Why is it.

To use the Rule of 72 to figure out when your money will double itself, all you need to know is the annual rate of expected return. If this is 10%, then you'll. Crunch the Numbers. The rule of 72 is an easy, back-of-the-napkin way to figure out how long it will take invested money to double given a set interest rate or. Benjamin Franklin said it best, "Money makes money. And the money that money makes, makes money." Plan ahead and learn to use compound interest and the Rule of. The Rule of 72 gives us an easy "back of the envelope" calculation for the time it will take to double our money. It is good for a range of typical interest. The Rule of 72 is a formula that estimates the amount of time it takes for an investment to double in value, earning a fixed annual rate of return. Discover the Rule of 72, the mental math shortcut that feels like magic but is grounded in financial wisdom. Learn how to effortlessly calculate the time it. Rule of How to Compound Your Money and Uncover Hidden Stock Profits [Jacobs, Tom, Del Vecchio, John] on ooomarketplace.ru *FREE* shipping on qualifying offers. The Rule of A Tool to Measure Small Steps to Wealth · $4, at age 31 (nine years later) · $8, at age 40 (nine more years) · $16, at age 49 (nine. Guided by the sharpness of its namesake mathematical formula, rule of 72 combines the muted elegance of saffron and geranium with vigorous natural Thai oud. It's called 'The. Rule of 72'. You take 72 and divide it by the interest rate. The answer is how long it will take you to double your money. Using the. The Rule of 72 is a great mental math shortcut to estimate the effect of any growth rate, from quick financial calculations to population estimates. By using the Rule of 72 formula, your calculation will look like this: 72/6 = This tells you that, at a 6% annual rate of return, you can expect your. The rule of 72 suggests that if you made no additional contributions from this point on, and your rate of return was 10% every year, you could potentially. To find out how many years it will take your investment to double, you can take 72 divided by your annual interest rate. For instance, if your savings account. The Rule of 72 yields the most accurate results when interest rates are low, usually between 6 and 10 percent. The formula gives the most precise answers when. The rule of 72 is only an approximation that is accurate for a range of interest rate (from 6% to 10%). Outside that range the error will vary from % to Rule of 72 Estimate: Exact Answer: Note. Whats the 72 rule? Its an easy way to estimate how long it will take investments to double through compound interest at a fixed annual rate. This can be done by. The Rule of Save money. Double time. Do you know The Rule of 72? It's an easy way to calculate just how long it's going to take for your money to double. The rule of 72 is a handy mathematical rule that helps in estimating approximately how many years it will take for an investment to double in value at a.

How To Look Up Stock Prices

To see all of the fields available for a company or fund, click the stock icon (Linked record icon for Stock) or select the cell and press Ctrl+Shift+F5. If. Enter the name of the company or a fund that you're looking for. You can also type in the stock ticker symbol directly, if you know it. Search stock. Search. Use the symbol finder to find stocks, funds, and other assets. Historical data provides up to 10 years of daily historical stock prices and volumes for each. "price" - Real-time price quote, delayed by up to 20 minutes. "priceopen "marketcap" - The market capitalization of the stock. "tradetime" - The. Find all stock quotes and get the latest stock prices as well as stock Nvidia's stock can't keep up with otherworldly expectations · An across-the. The S&P extended its monthly winning streak to 4 months ending up We look forward to welcoming more leading companies from around the world in. Online brokerage sites such as eTrade and TD Ameritrade or apps like Robinhood will have both real-time and historical quote data for customers and usually. When researching a stock, use the research tools available under the Research Trade tab that. Items you might know. You're likely familiar. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage. To see all of the fields available for a company or fund, click the stock icon (Linked record icon for Stock) or select the cell and press Ctrl+Shift+F5. If. Enter the name of the company or a fund that you're looking for. You can also type in the stock ticker symbol directly, if you know it. Search stock. Search. Use the symbol finder to find stocks, funds, and other assets. Historical data provides up to 10 years of daily historical stock prices and volumes for each. "price" - Real-time price quote, delayed by up to 20 minutes. "priceopen "marketcap" - The market capitalization of the stock. "tradetime" - The. Find all stock quotes and get the latest stock prices as well as stock Nvidia's stock can't keep up with otherworldly expectations · An across-the. The S&P extended its monthly winning streak to 4 months ending up We look forward to welcoming more leading companies from around the world in. Online brokerage sites such as eTrade and TD Ameritrade or apps like Robinhood will have both real-time and historical quote data for customers and usually. When researching a stock, use the research tools available under the Research Trade tab that. Items you might know. You're likely familiar. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage.

However, Apple still remains his top holding. In this piece, we'll take a look at 2 stocks that are in an uptrend with. Google Finance provides real-time market quotes, international exchanges, up-to-date financial news, and analytics to help you make more informed trading. Review historical stock prices, assess industry relative performance, and browse latest company headlines. Quicken's One-Click Scorecard puts analyst insight at. NOTE: The Closing Price, Day's High, Day's Low, and Day's Volume have been adjusted to account for any stock splits and/or dividends which may have occurred for. Get a stock quote. Just enter in a stock or mutual fund symbol to get timely stock and mutual fund price quotes from the S&P , NYSE, NASDAQ and the Dow. Year End Stock Prices The historical stock information provided is for informational purposes only and is not intended for trading purposes. The historical. Databases like Factset and the Bloomberg terminal have deep historical reach in terms of stock prices, but the Library doesn't subscribe to either. However, the. Stock Price Performance · Stock Quote · Stock Chart · Stock Quote · Stock Chart · Historical Price Lookup · WEEK OF August 26, · Historical Share Prices Prior to. Stock Data · · Stock Chart · Historical Price Look Up · Investment Calculator · Analyst Coverage · Learn More. Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are. Stock and equity quote look-up. Free market investment research tools from MarketWatch including stock screeners, fund finders, ETF profiles, earnings calendars, IPO filings and more. Updated world stock indexes. Get an overview of major world indexes, current values and stock market data. Free real-time stock quotes, news, charts, time&sales, options and more for Nasdaq, NYSE and the OTC exchanges. Keep all your stocks in a Watchlist or store. Sites like Bloomberg and MarketWatch are among the most popular, as well as Yahoo Finance. The key is knowing what to look for and what you want to do with that. Stock market data coverage from CNN. View US markets, world markets, after hours trading, quotes, and other important stock market activity Up-to-date stock. Sign in to your brokerage account, look at previous broker statements, contact your brokerage firm, go online for historical stock prices, go directly to the. Syntax · ticker - The ticker symbol for the security to consider. · attribute - [ OPTIONAL - "price" by default ] - The attribute to fetch about ticker from. Databases like Factset and the Bloomberg terminal have deep historical reach in terms of stock prices, but the Library doesn't subscribe to either. However, the.

Why Are Refinance Rates Going Up

The average rate on a year fixed-rate mortgage went up one basis point to % APR, and the average rate on a 5-year adjustable-rate mortgage went up two. The jumbo rates quoted above are for loan amounts above $, up to $1,, Percentage Rate (APR) may increase after the original fixed-rate period. Mortgage rates are expected to decline later this year as the U.S. economy weakens, inflation cools and the Federal Reserve cuts interest rates. A lower interest rate may mean lower mortgage payments each month. Plus, saving on interest means you end up paying less for your house overall and build equity. move to be bigger than those seen in recent days. (view article). Download our Mobile App and set up alerts for mortgage rate updates. Sign up for our Daily. up alerts for mortgage rate updates. Sign up for our Daily Email Newsletter Refinance. Loan Term. 10 Yr Fixed, 15 Yr Fixed, 20 Yr Fixed, 30 Yr Fixed, 3. Mortgage rates may continue to rise in High inflation, a strong housing market, and policy changes by the Federal Reserve have all pushed rates higher in. So, paying a higher interest rate on a mortgage refinance might be a good financial decision if that higher rate is still lower than the interest rates on your. If rates go up people will kick themselves for not buying sooner, if rates go down they can refinance and will be happy that they bought when. The average rate on a year fixed-rate mortgage went up one basis point to % APR, and the average rate on a 5-year adjustable-rate mortgage went up two. The jumbo rates quoted above are for loan amounts above $, up to $1,, Percentage Rate (APR) may increase after the original fixed-rate period. Mortgage rates are expected to decline later this year as the U.S. economy weakens, inflation cools and the Federal Reserve cuts interest rates. A lower interest rate may mean lower mortgage payments each month. Plus, saving on interest means you end up paying less for your house overall and build equity. move to be bigger than those seen in recent days. (view article). Download our Mobile App and set up alerts for mortgage rate updates. Sign up for our Daily. up alerts for mortgage rate updates. Sign up for our Daily Email Newsletter Refinance. Loan Term. 10 Yr Fixed, 15 Yr Fixed, 20 Yr Fixed, 30 Yr Fixed, 3. Mortgage rates may continue to rise in High inflation, a strong housing market, and policy changes by the Federal Reserve have all pushed rates higher in. So, paying a higher interest rate on a mortgage refinance might be a good financial decision if that higher rate is still lower than the interest rates on your. If rates go up people will kick themselves for not buying sooner, if rates go down they can refinance and will be happy that they bought when.

interest and (if applicable) any required mortgage insurance. ARM interest rates and payments are subject to increase after the initial fixed-rate period (5. The average APR for a year fixed refinance loan fell to % from % yesterday. This time last week, the year fixed APR was %. Meanwhile, the. Why Refinance? Refinancing to a lower interest rate may reduce your monthly mortgage payment and increase your cash flow. Refinancing when interest rates. Locking your mortgage rate before interest rates rise can mean significant savings over the term of your loan. But when is the right time, and what fees are. Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue their decline and while potential homebuyers are. That said, the new standard conforming loan limit is $,, and high balance limits in select high-priced areas can go up as high as $1,, for. If your home's value has gone up since you got your loan, you might now own 20% of its value, even if you haven't paid down the loan to that level. This happens. Current mortgage rates continue to rise and record payment rates combine to create a glum market. Refinance rates are generally higher compared with mortgage purchase rates. Generally, rates are higher to account for a slightly greater risk for refinance. Overall, the increased risk associated with refinance mortgages contributes to their higher rates compared to purchase mortgages. High rates and the “mortgage rate lock-in” effect, which makes homeowners reluctant to sell, continue to drive up home prices. As of late , nearly 60% of. If interest rates dropped, and you could get a year fixed-rate mortgage at 6%, your monthly payments would rise to about $1, While that's $ more than. Below are a few scenarios where refinancing your mortgage makes sense even during times of rising rates. Today's Refinance Rates · Mortgage Refinance Calculator · Home Value Estimator Set up and maintain automatic monthly payments from your Bank of America. Should I Refinance When Interest Rates Are Going Up? This seems to be the age-old question, but really depends on why you want to refinance. Whether that's. Economic growth and employment rates: Strong economic growth can increase mortgage rates due to higher capital demand; economic downturns may lower rates to. On November 17, , Freddie Mac changed the methodology of the Primary Mortgage Market Survey® (PMMS®). The weekly mortgage rate is. Interest rates change when the prime rate changes. Illustration showing three things you can do. Refinancing may provide an opportunity to get a better interest rate or make a good mortgage even better. Either way, you'll increase your short- and long-term. Raise your credit score. · Budget some extra cash to pay points. · Shop and haggle with refinance lenders. · Compare APRs and interest rates. · Avoid second.

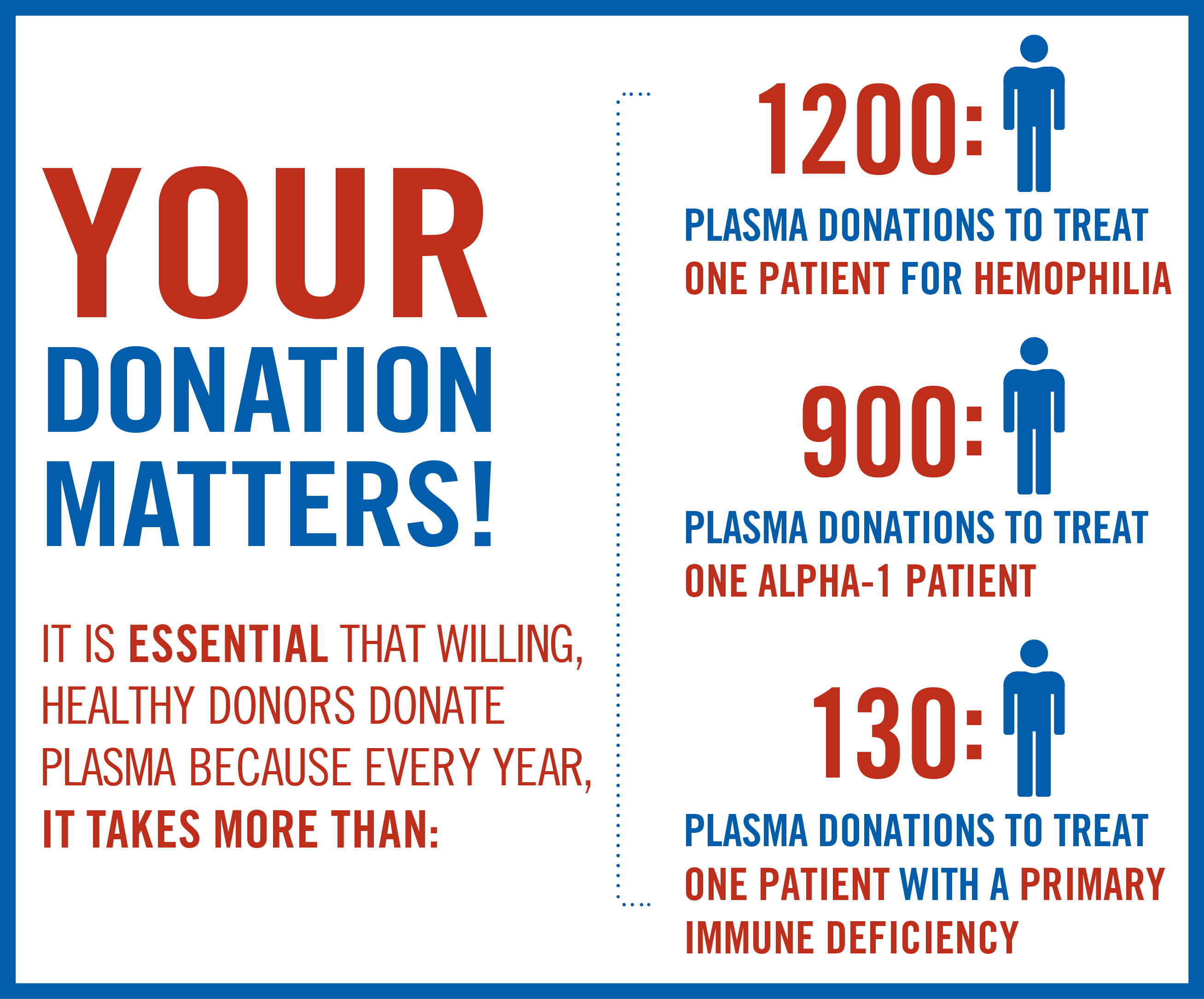

Pay To Give Plasma

Donate your plasma for money as there is a worldwide need for plasma donors because plasma is a critical component of many life saving treatments. KEDPLASMA has over 70 donation centers across the country. Find out which one is closest to you and the services and plans it offers. Plasma donations generally involve compensation. It takes about 90 minutes to donate plasma, and you should expect to be there for at least two hours. You and Biolynk will agree upon a compensation amount before you donate your plasma (up to $ per donation, based on qualification). I would say minimum if you go twice a week and are able to donate both times youre looking at at least $ a month. You can earn hundreds of dollars every month by spending a few hours each week donating plasma. The more you donate, the more you earn! Donating plasma takes time and commitment. To help ensure a safe and adequate supply of plasma, donors are provided with a modest stipend to recognize the. PSG pays qualified donors a minimum of $ per plasma donation. A great need exists for human plasma rich in specialty antibodies to manufacture diagnostic. Join the AB Elite by making a plasma-only donation at select Red Cross blood donation centers today. Schedule by calling RED CROSS (). Donate your plasma for money as there is a worldwide need for plasma donors because plasma is a critical component of many life saving treatments. KEDPLASMA has over 70 donation centers across the country. Find out which one is closest to you and the services and plans it offers. Plasma donations generally involve compensation. It takes about 90 minutes to donate plasma, and you should expect to be there for at least two hours. You and Biolynk will agree upon a compensation amount before you donate your plasma (up to $ per donation, based on qualification). I would say minimum if you go twice a week and are able to donate both times youre looking at at least $ a month. You can earn hundreds of dollars every month by spending a few hours each week donating plasma. The more you donate, the more you earn! Donating plasma takes time and commitment. To help ensure a safe and adequate supply of plasma, donors are provided with a modest stipend to recognize the. PSG pays qualified donors a minimum of $ per plasma donation. A great need exists for human plasma rich in specialty antibodies to manufacture diagnostic. Join the AB Elite by making a plasma-only donation at select Red Cross blood donation centers today. Schedule by calling RED CROSS ().

Make a difference by donating plasma at ABO Plasma Collection Centers. Donating plasma can save lives—join us today and be rewarded for your contribution! How much money you make depends on where you're located and how much you weigh. (Typically, the more a donor weighs, the more plasma can be. Your First Plasma Donation: A Step-by-Step Guide. Step 1: Warm Welcome and Initial Paperwork ( minutes). Step 2: Health Screening and Physical Exam. Generally, plasma donors must be 18 years of age and weigh at least pounds (50kg). All individuals must pass two separate medical examinations, a medical. Be rewarded for donating plasma at CSL Plasma. Learn how to receive compensation for plasma donation. Program varies by location and is subject to change. Making a plasma donation in Cherry Hill is a simple process. As a first-time donor, you will need to schedule an appointment before visiting the Plasma. Plasma donations can help folks impacted by more than 80 different diseases, including neurological disorders, immune deficiencies, and hemophilia. Compensation is based on appointment type, up to $ per collection appointment. What is a Health Screening or Prescreen appointment? You will be compensated every time you donate. As a qualified donor, you can donate plasma up to 2 times a week. You will be financially compensated each time. Plasma donations take longer than a typical blood donation. First-time donors should plan to be at PlasmaSource for about 2 hours. Plasma donors can give every 28 days. Some Vitalant centers have special plasma programs that allow for more frequent donation. Please check with your local. Donating plasma is a wonderful way to help patients facing serious health challenges. We want to make this experience safe, easy, and rewarding for donors. Unlike a whole blood donation, where you give whole blood with all three blood components—plasma donations use a special automated process called apheresis . You earn money for your time spent donating plasma at LFB Plasma donors can donate two times a week. For specific compensation information, please get in touch. Yes, you can donate plasma if you're between 18 and 70 weigh at least lbs., and in good health. If you have rhNeg blood, we especially need you for our. After each donation, your compensation will be sent to you. A qualified donor can donate plasma twice in every 7 days period at the most. You will receive up to. The NYBC Donor Advantage Program rewards frequent blood, platelet and plasma donors. Earn points with each donation and redeem them for gifts or gift cards. You earn money for your time spent donating plasma at LFB Plasma donors can donate two times a week. For specific compensation information, please get in touch. After each donation, your compensation will be sent to you. A qualified donor can donate plasma twice in every 7 days period at the most. You will receive. Grifols Plasma has united some of the best plasma donation centers in the industry under our Grifols network, allowing you to donate plasma across the.