Business Update Blog, June 4 – Highlights from Today

Indices on Wall Street rose at the open as President Trump urged US Federal Reserve Chair Jerome Powell to reduce interest rates.

Following a disappointing ADP jobs report that revealed a significant drop in private sector job growth for May, Trump referred to Powell as “Too Late Powell”.

The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all increased by 0.2 percent with investors anticipating upcoming non-farm payroll numbers.

In the UK, the FTSE 100 index gained 0.2 percent, reaching 8,804.75, marking the fourth consecutive increase. The British pound also strengthened by 0.2 percent against the US dollar, trading at $1.3543.

Reiterating his stance, President Trump called for action from Powell after ADP’s latest figures indicated that private employment rose by just 37,000 jobs, the slowest pace since March 2023.

Trump expressed his frustration via social media, stating, “ADP NUMBER OUT!!! ‘Too Late’ Powell must now LOWER THE RATE. He is unbelievable!!! Europe has lowered NINE TIMES!”

In retail news, British clothing retailer Weird Fish announced plans to expand its footprint across the UK following record revenues reported last year.

The brand, known for coastal-inspired outdoor apparel, aims to introduce ten new standalone shops and 15 additional concessions this year as annual revenue grew by 11.4 percent to £42.6 million.

Profit before tax also saw an increase, climbing to £4.2 million in 2024 compared to £1.4 million in the previous year.

Marlowe, a provider of business software, is currently in discussions regarding an acquisition by outsourcer Mitie Group.

With a market value of £322.37 million, Marlowe specializes in compliance and risk management services, including health and safety support to UK businesses. As per City rules, Mitie has until 5 PM on July 2 to provide clarity on its intentions regarding the potential acquisition.

Marlowe serves approximately 27,000 clients from various sectors, including office buildings, retail, and industrial locations.

The FTSE 100 rose 0.25 percent, or 21 points, to 8,808.47 after the UK secured a brief exemption from Trump’s increased tariffs on steel and aluminium imports.

The positive momentum followed market speculation, as the London share index had initially opened flat.

Melrose Industries, Babcock, and Sprix gained as their outlook improved. Antofagasta’s stocks also rose after copper prices steadied.

Conversely, disappointing results from discount retailer B&M exerted pressure on its sector, negatively impacting M&S and J Sainsbury as well as consumer healthcare firm Haleon.

Analysts believe the UK economy is poised for stronger performance in the second quarter, having revised the composite PMI up for May.

Matt Swannell, chief economic advisor at the EY Item Club, emphasized that PMI surveys often underestimate actual economic activity due to their reliance on sentiment.

He added, “Recent survey data have been particularly affected by announcements on tariffs from the US. However, with the revised May PMI data reflective of growth, it seems likely that GDP for Q2 will exceed previously reported survey metrics.”

The composite PMI, which surveys both the service and manufacturing sectors, climbed to 50.3 in May, surpassing the previous month’s figure of 48.5 and exceeding the anticipated reading.

Paragon Banking Group reported an increase in buy-to-let mortgage lending despite concerns over new legislation aimed at renters.

The FTSE 250-listed bank announced a 25.1 percent rise in new loans issued to landlords, reaching £812.2 million compared to £649.3 million previously.

Profits before tax rose by 26.7 percent to £140.1 million in the six months ending March from £110.6 million the previous year. This increase comes even as the firm set aside £6.5 million for potential compensation claims in its motor finance division.

Nigel Terrington, Paragon’s CEO, noted, “We delivered another robust financial performance in the first half of 2025, reflecting our disciplined approach and consistent execution record.”

Shares of DiscoverIE surged by 12 percent this morning, as the company reported that the impact of Trump’s tariffs would likely be minimal.

The electronic components firm generated nearly a quarter of its sales in the US in 2024, with over 50 percent of that production occurring locally.

DiscoverIE indicated that the tariffs could provide a competitive advantage over rival firms affected by similar barriers, as it is well-positioned to adjust its manufacturing to meet customer demands.

Sales dipped by 3 percent year-on-year to £422.9 million, but profit before tax increased by 44 percent to £32 million. Adjusted operating profit also saw a 6 percent rise, achieving a record £60.5 million.

The board proposed a 4 percent increase to its final dividend, raising the overall dividend to 12.5p per share from last year’s 12p.

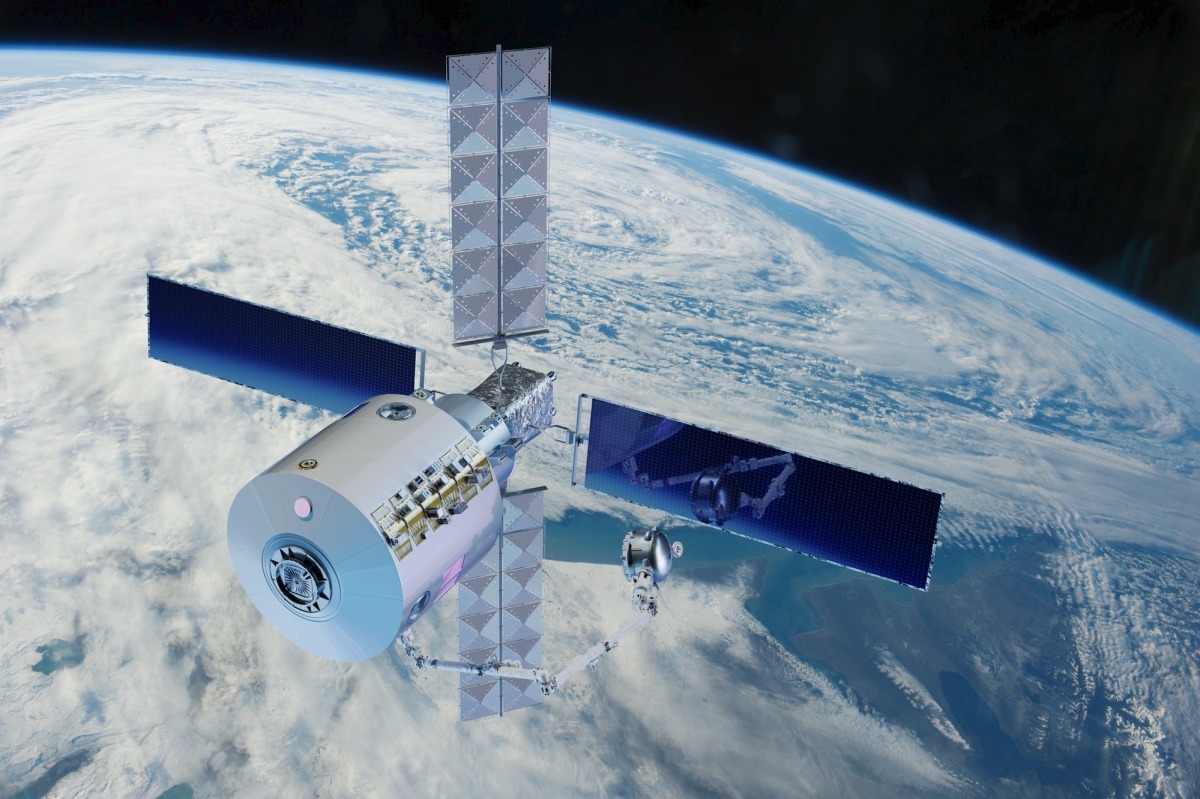

Seraphim, a space investment firm listed in London, is experiencing growth due to increased military interest in satellite technology.

The investment trust’s portfolio value expanded 3 percent to £222.7 million in the quarter ending March, focusing on technologies with potential military applications, including Iceye, known for high-resolution nighttime imaging.

Early investors in Seraphim include prominent entities like the British Business Bank, Airbus, and the European Space Agency. The firm listed on the London Stock Exchange in 2021 and its holdings now include HawkEye 360 and Voyager, a developer of commercial space stations nearing IPO.

CEO Mark Boggett remarked that the space sector is currently experiencing a notable increase in demand driven by defense initiatives.

Recent data from the Office for National Statistics revealed a decline in the average sickness absence rate to just over four days per worker annually.

An estimated 148.9 million workdays were lost in the UK in 2024 due to illness or injury, with the percentage of hours lost decreasing by 0.3 points to 2 percent. Groups with the highest absence rates included women, older employees, those with chronic health issues, part-time workers, and public sector staff.

Amanda Walters, director of the Safe Sick Pay campaign, commented, “While the reduction in sickness absence might appear positive, it obscures the reality that many UK workers report for duty despite being unwell.”

Tesla encountered an eighth consecutive month of declining sales for its vehicles produced in China during May.

Deliveries of the Model 3 and Model Y models fell 15 percent year-on-year to 61,662, as reported by the China Passenger Car Association.

This downturn poses challenges for CEO Elon Musk, who has intensified his focus on boosting sales amid his controversial political stances and heightened competition in the world’s largest automobile market.

Shares in Tesla have increased since Musk announced his resignation from the Department of Government Efficiency (Doge).

4Global, a sports data firm with involvement in previous Olympics, plans to exit the London stock market, highlighting concerns regarding the vulnerabilities of smaller market segments.

The company revealed intentions to leave Aim, London’s junior market for stocks, pending a shareholder vote later this month.

Having lost over 80 percent of its market value since its debut in 2021, 4Global stated it has struggled to secure adequate capital publicly, believing private fundraising may yield better opportunities.

By relinquishing its Aim listing, 4Global aims to secure a more sustainable cash flow for future growth, including expansion into new markets.

Airbus shares surged after reports suggested Chinese airlines are contemplating orders for up to 300 jets in the coming month during anticipated European diplomatic visits to Beijing.

Airbus shares rose 3.86 percent to €172.86 this morning, with reports hinting that the order could even reach 500 aircraft. Initial discussions reportedly commenced last April in conjunction with President Xi’s visit to France.

A successful order would create competitive pressure for Airbus’s American rival Boeing. Trump commented on Xi this morning, stating, “I like President Xi of China, always have, and always will, but he is VERY TOUGH, AND EXTREMELY HARD TO MAKE A DEAL WITH.”

Sir Martin Sorrell’s S4 Capital alerted investors of expected revenue declines due to market apprehension regarding US tariff increases amidst global economic instability.

The conditions over the initial five months of 2025 were characterized by ongoing volatility, as indicated by the company.

Clients, particularly within the tech sector—which contributes nearly half of its revenue—are prioritizing investment in AI over marketing spend.

S4 Capital’s full-year net revenue is projected to drop by low single digits, yet operational earnings are anticipated to remain stable similar to 2024. The company’s shares climbed by 4.85 percent to 27 pence this morning.

In a survey released today, the UK’s essential services sector was reported to have returned to growth in May, spurring optimism to a seven-month high.

The finalized S&P Global purchasing managers’ index (PMI) for services jumped to 50.9 in May from 49 in the prior month, confirming growth as it surpassed the 50-point threshold separating expansion from contraction. Analysts had expected no change from the previous reading.

Economists indicated that the uptick in optimism was influenced by President Trump’s easing of stringent tariffs, which had previously unsettled markets and caused an uptick in investor confidence.

Tim Moore, director of economics at S&P Global Market Intelligence, stated, “The service sector regained stability in May, benefiting from decreased apprehension surrounding US tariffs, recovering global financial conditions, and enhanced client confidence that supported output growth.”

WH Smith confirmed it is proceeding with the sale of its UK high street chain to Modella Capital, owner of Hobbycraft, with completion expected by month-end.

The £76 million transaction will lead to the elimination of the WH Smith name from British streets, replaced by the TGJones brand. Prior to the deal’s finalization, WH Smith reported encouraging performance in its travel division, achieving a 5 percent like-for-like sales increase as of May 31.

In the travel sector, a 6 percent rise in comparable sales was recorded over the third quarter, with airport shops performing particularly well, showing a 7 percent growth.

Meanwhile, performance in North America showed a modest increase, with comparable store sales up 2 percent, or 7 percent on a constant currency basis.

The FTSE 100 stood steady at 8,787.53 while the FTSE 250 experienced a slight rise of 69.80 points, or 0.33 percent, reaching 21,087.77.

Resource companies, particularly the precious metals miner Fresnillo, led the market gains. Though Fresnillo’s positive performance can be attributed to its apparent insulation from Trump’s steel tariffs, the reason behind other mining firms’ share valuations rising remains uncertain.

Firms like Anglo American and Glencore could be experiencing the market’s belief that the tariffs reflect a pattern of Trump’s trade negotiations.

Defence contractor Babcock continues to see positive investor sentiment following the recent publication of the government’s strategic defence review.

Germany’s DAX index increased by 185.46 points, or 0.78 percent, to 24,278.43 while France’s CAC 40 rose by 22.17 points, or 0.29 percent, to 7,786.6.

French spirits producer Rémy Cointreau has retracted its 2030 sales growth objectives amid doubts related to tariffs and weakened US sales.

It acknowledged the feasibility of achieving 2030 targets is compromised under current market conditions. “Rémy Cointreau indicates that the foundational elements to maintain its 2029-2030 objectives are absent,” it stated.

The brand cautioned that stagnating US sales and tariffs affecting cognac distribution in China and the US could result in significant reductions in operating profit for 2025/26.

In the year ending in March, the company observed a lesser than expected 30.5 percent drop in annual organic operating profit, amounting to €217 million compared to anticipated declines.

Rita-Rose Gagné will step down as chief executive of Hammerson, the property firm that owns major shopping centers like the Bullring and Cabot Circus next year.

Gagné is credited with stabilizing Hammerson, which faced considerable financial difficulties at her assumption of leadership in 2020.

In a recent interview, she emphasized her background as the second youngest of eight siblings, fostering her competitive spirit and drive for success.

B&M European Value Retail released a statement asserting its strong position to deliver long-term shareholder value amid the difficulties posed by minimum wage regulations and increasing taxes.

The company reported a 13 percent decline in annual pre-tax profit to £431 million, while revenue increased by 3.7 percent to £5.57 billion.

Once a favored stock during the pandemic, B&M’s shares have plummeted nearly 40 percent over the past year due to inflationary pressures and rising competition impacting profit margins and consumer spending.

Asian markets reacted positively to the recent tariff hikes on steel and aluminum, showing resilience following President Trump’s moves.

The tariff increase, which precedes an approaching deadline for trading partners to present their proposals, could evoke a retaliatory response as these tariffs are set to take effect in early July.

The FTSE 100 is projected to open slightly higher, notwithstanding the UK’s temporary exemption, which allows some time for negotiations with the United States. In Asian trading, Japan’s Nikkei index gained 0.8 percent while China’s SSE Composite rose 0.4 percent.

B&M European Value Retail and WH Smith plan to share performance updates with investors later today. Other companies releasing market insights include Paragon Banking Group, a major player in buy-to-let lending.

Additionally, the forthcoming services PMI data is highly anticipated, especially as the services sector constitutes over 80 percent of the UK economy, with May’s preliminary reading hinting at a rebound following previous contraction.

• President Trump granted an exemption to British steel and aluminum exports from significant new tariffs, allowing five weeks for UK ministers to finalize a trade deal with the United States. • KKR, an American private equity firm, withdrew its £4 billion equity offer for Thames Water after concerns arose regarding political influences post-government discussions. • Robin Totterman, founder of British eyewear manufacturer Inspecs, will relinquish his chairmanship after leading the company for nearly 40 years. • The European Central Bank is likely to announce another interest rate cut this week as inflation in the Eurozone drops below the target of 2 percent.

Post Comment